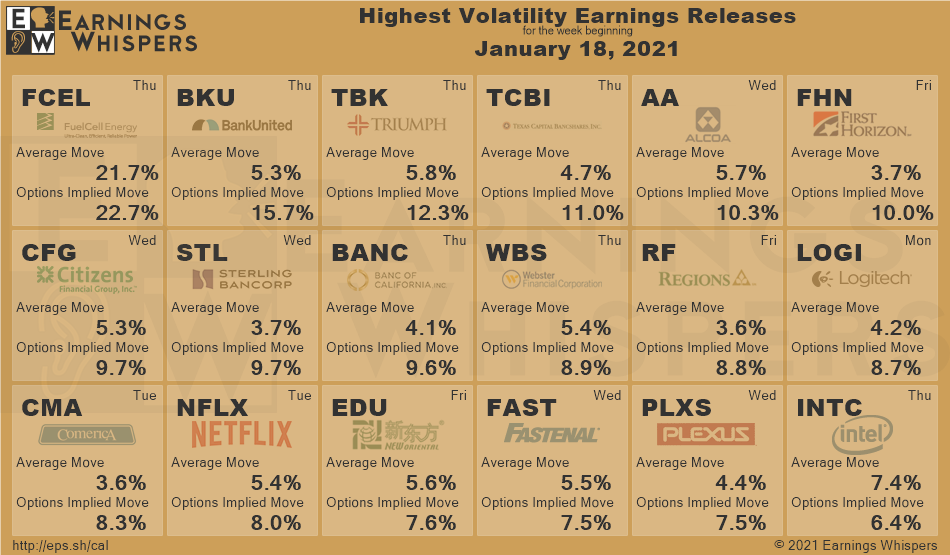

so the first batch of ERs is nearly upon us.

some really interesting opportunities here.

two things im keeping an eye on;

1) i want to be ready to launch fairly deep OTM put spreads at XLF if we see consistent red openings on bank er's.

2) im thinking ITM put spreads on netflix might be the order of the day because honestly investors tend to fixate on subscription numbers and despite another shutdown/lockown being in the mix, im not sure netflix hasnt peaked there. disney, hbo, etc are drinking its fucking milkshake, ESPECIALLY with hbo showing actual theater run films.

i do want to see how much the market recovers from last weeks dip before i commit, i dont want to fight macro market movement (the worlds most expensive hobby).

but yeah if spooz closes at above like, 3950 tomorrow, i expect NFLX to be trading around 515+'ish at close, and i can do something like a 532.50/535 put spread.. if we open 2% down, thats +22% profit, if we open 2% up, its a -6% loss, give or take. plus we've seen many occasions where buyers take profits on positive ERs and we end up closing red then recovering later in the week... and if we just tread water, we can either cash out at +4 to +8% on wed or see if we can close the week under +3.9% and pocket 47.9% at expiration.

ill also be keeping an eye on INTC. a lot of the 'where id put 10k in 2021' articles mention INTC. if it opens green on friday and stays green its going to make QQQ and friends look attractive.

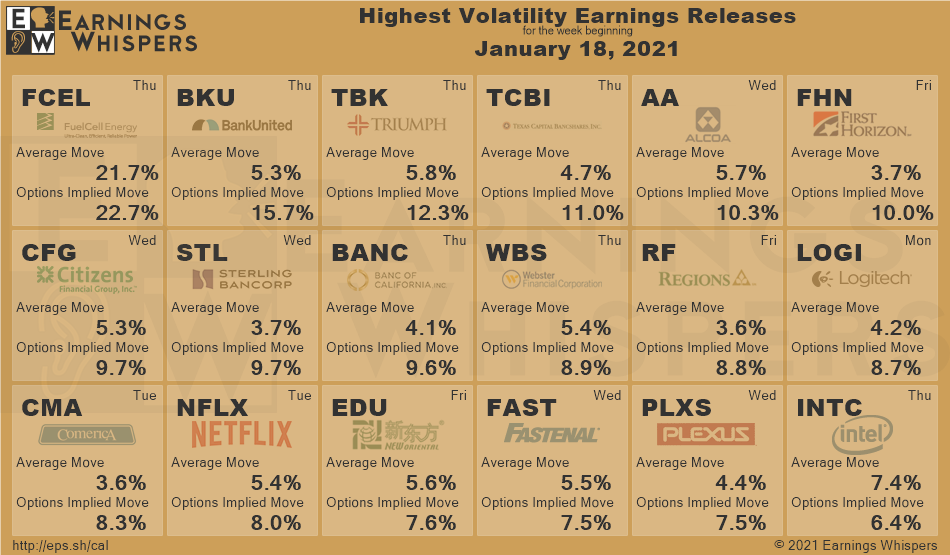

some really interesting opportunities here.

two things im keeping an eye on;

1) i want to be ready to launch fairly deep OTM put spreads at XLF if we see consistent red openings on bank er's.

2) im thinking ITM put spreads on netflix might be the order of the day because honestly investors tend to fixate on subscription numbers and despite another shutdown/lockown being in the mix, im not sure netflix hasnt peaked there. disney, hbo, etc are drinking its fucking milkshake, ESPECIALLY with hbo showing actual theater run films.

i do want to see how much the market recovers from last weeks dip before i commit, i dont want to fight macro market movement (the worlds most expensive hobby).

but yeah if spooz closes at above like, 3950 tomorrow, i expect NFLX to be trading around 515+'ish at close, and i can do something like a 532.50/535 put spread.. if we open 2% down, thats +22% profit, if we open 2% up, its a -6% loss, give or take. plus we've seen many occasions where buyers take profits on positive ERs and we end up closing red then recovering later in the week... and if we just tread water, we can either cash out at +4 to +8% on wed or see if we can close the week under +3.9% and pocket 47.9% at expiration.

ill also be keeping an eye on INTC. a lot of the 'where id put 10k in 2021' articles mention INTC. if it opens green on friday and stays green its going to make QQQ and friends look attractive.

Comment