X

-

-

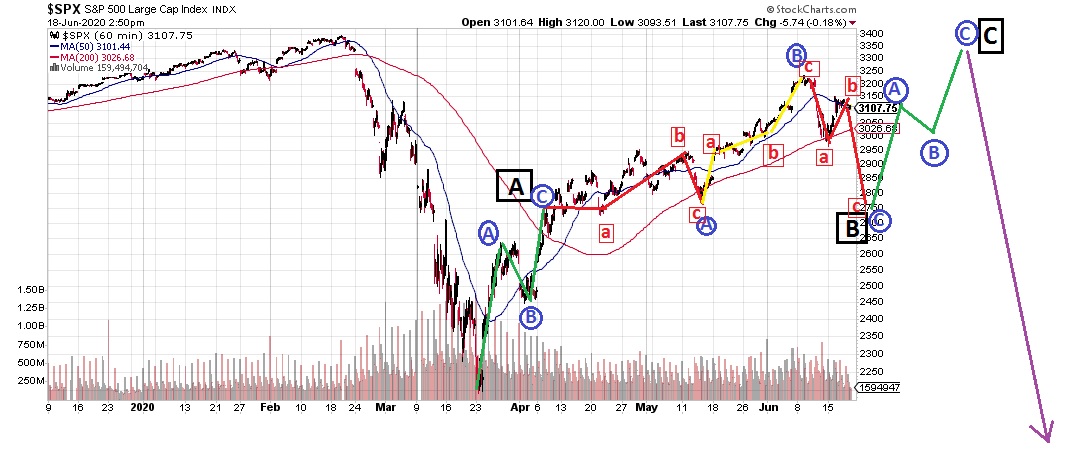

3150 has been a trustworthy little moneymaker. Spy can’t get traction as opposed to NDX.

remember shorting the dollar. .382 retracement back up. Tomorrow we will see if it’s healed or continues it’s struggle. Like you, I passed as I have enough wiggles to chase. You were right though.

btw crack 3140 at close I’m gonna be one happy camper.

i think Navarro shitshow softened up my opponents

Comment

-

Joe Rich

1/ I've been investing for 22 years, and I've never seen irrational exuberance and false hope around equities like we're experiencing right now. Over the past few weeks, many people who I've followed my entire investing life have gone bonkers, jumping on the bandwagon.

2/ It's ironic that this is all coming at the point in time when the US economy is the worst it's been in my lifetime. Reality is being ignored, and seemingly just about everyone is investing based on faith and hope. Faith and hope are for religion, not business.

3/ So many people believe in "Don't fight the Fed" at a time where the Fed has zero ability to fix any of the issues that plague the economy and dampen the outlook for risk assets. It's also a time where we have the least qualified and least competent Fed Chair in history.

4/ So, just so I can sleep well tonight knowing I tried my best, here is a list of all of the issues facing us right now of which the Fed has zero control:

5/ Insolvency - personal, corporate, and sovereign - on a scale the world has never seen.

Demographics - an aging Boomer population who owns most of the country's assets leaving the workforce in droves.

Political and civil unrest leading to protesting and riots in the streets

6/ Trade conflict with the US' largest trading partner, China

Global supply chain disruption

Collapsing emerging markets all over the world

Corporate profits cratering to levels lower than during the GFC

7/ An upcoming election that will likely result in the most left-leaning government the US has seen since the 1940's. Higher corporate taxes, more corporate and environmental regulations are a guarantee.

8/ Unemployment at the highest level in modern American history.

Real estate - both commercial and residential - ready to absolutely implode as 106 million loans across the country are delinquent.

9/ Global unrest with conflicts pitting two nuclear powers (China & India), a resurgent North Korea, and unending wars in the Middle East.

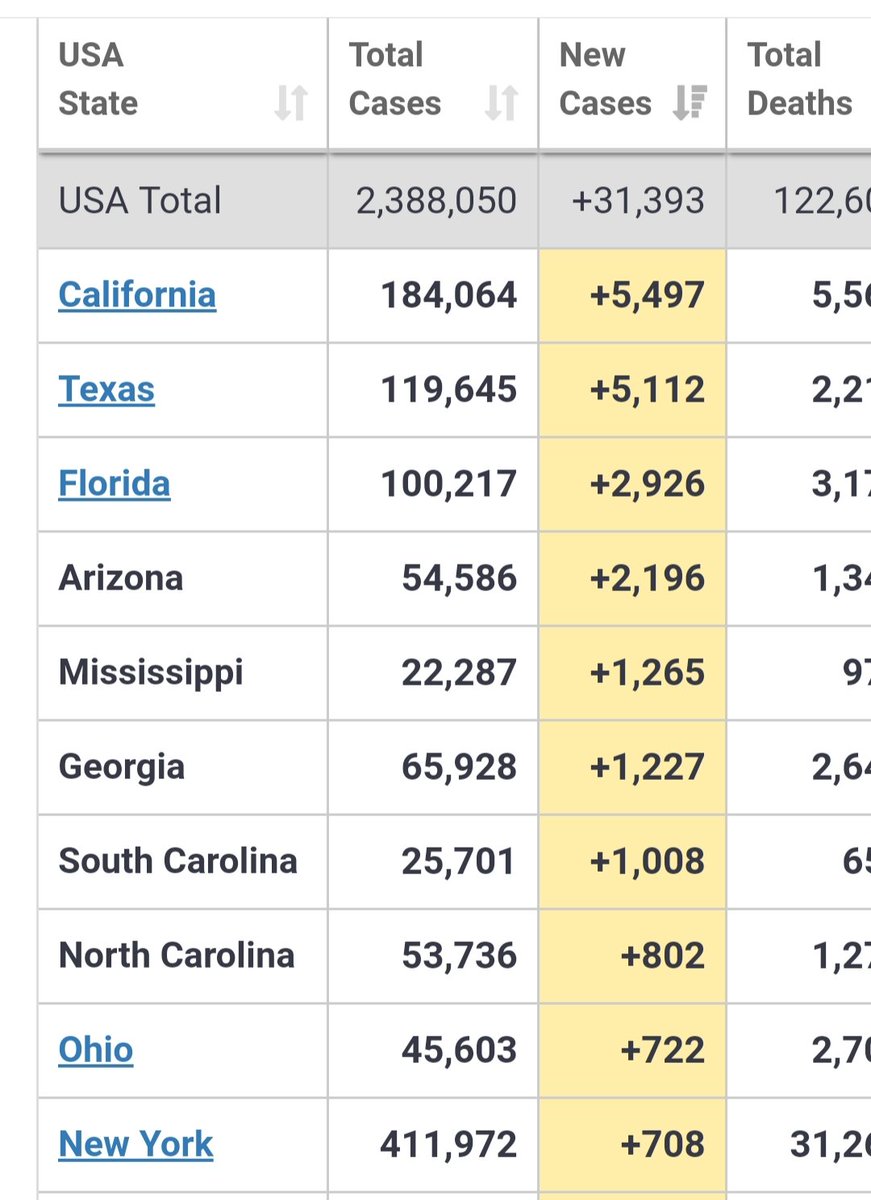

10/ And finally, COVID-19. Unless the Fed can find a way to cure this disease, consumer confidence and uncertainty for businesses will continue to pound the global economy.

11/ In closing, I don't want to be bearish. I want 5% annual GDP growth and stocks to soar as a result. But that isn't our reality. I'd rather invest my money safely in other areas and rely on my own ingenuity than be a drug addict begging Daddy Jerome for my next fix.

12/ Because eventually that fix either isn't going to come or it's going to be laced with Fentanyl and the whole system is going to die.

- Likes 1

Comment

-

-

honestly i feel the same way, like what the fuck bullets does the fed have left... the whole market is hanging off tech's nuts and with the ad embargo on facebook, watching goog drop 5.65% felt like a preview, not a result.

honestly who knows where this shit goes. im just trying to stay flexible and string together those green days.

Comment

Comment