no bullshit im going to be doing some sort of podcast/video about this. he absolutely 100% had fuckall to do with the flash crash, that much is obvious.

X

-

FYI im going to be making a video about Nav soon.

interesting tidbits....

he started trading futures in 2003, and by 2007 (when he worked for Futex) had a 400k bankroll. he would place up to 100 lot emini orders and target 5 point / $25,000 profits for the day.

thats a pretty fascinating tidbit right there, btw. 5 points = 20 ticks. he traded constantly so to clear 25k in profit, he probably had to clear 35-40k before round trip fees, commissions, and of course the profit split to Futex.

so many questions tho.. like it really sounds like he didnt swing or build positions nearly as often as he would just ape the fuck into a 100 lot scalp and fuck off whenever the ladder got spooky. he probably targeted 2-3 ticks on average.

Comment

-

january 2008, he brought his balance up to 1.4m USD largely by placing 200 lot DAX bets against someone longing the German market every single night. he assumed it was the Chinese, because he was insane. it wasnt the Chinese. it was a rogue French investment banker who ended up costing his bank 7.2 billion dollars after, hilariously, earning them over 7 billion by staying late and doing the gamble gamble thing on DAX.

it worked until it didnt.

Comment

-

anyway thats where the party started, thats where he got his roll.

he started trading 500 lot emini contracts.

let me put this in perspective for anyone whose not terribly familiar with this shit;

SPY closed at 422.60 on friday, more or less, and emini's closed at 4227.75. both of these things essentially measure the same thing; SPY is an ETF that mimics the S&P 500's value, which is what emini futures contracts represent.

if SPY goes to 422.70, emini would more or less go to 4228.75. thats a 1 point / 4 tick move.

nav's 500 lot position, closed out at up 1 point or 4 ticks, would have turned $25,000 profit.

Comment

-

anyway thats really where the good times end. the HFT crews started to show up in force around 2008 and suddenly nav couldnt read the ladder so well and so he started to spoof back and the rest is more or less history, but he did manage to earn $70,000,000 in the process and if he had bothered to incorporate and hire a proper team of lawyers the SEC would have likely never gone beyond sending him a nastygram.

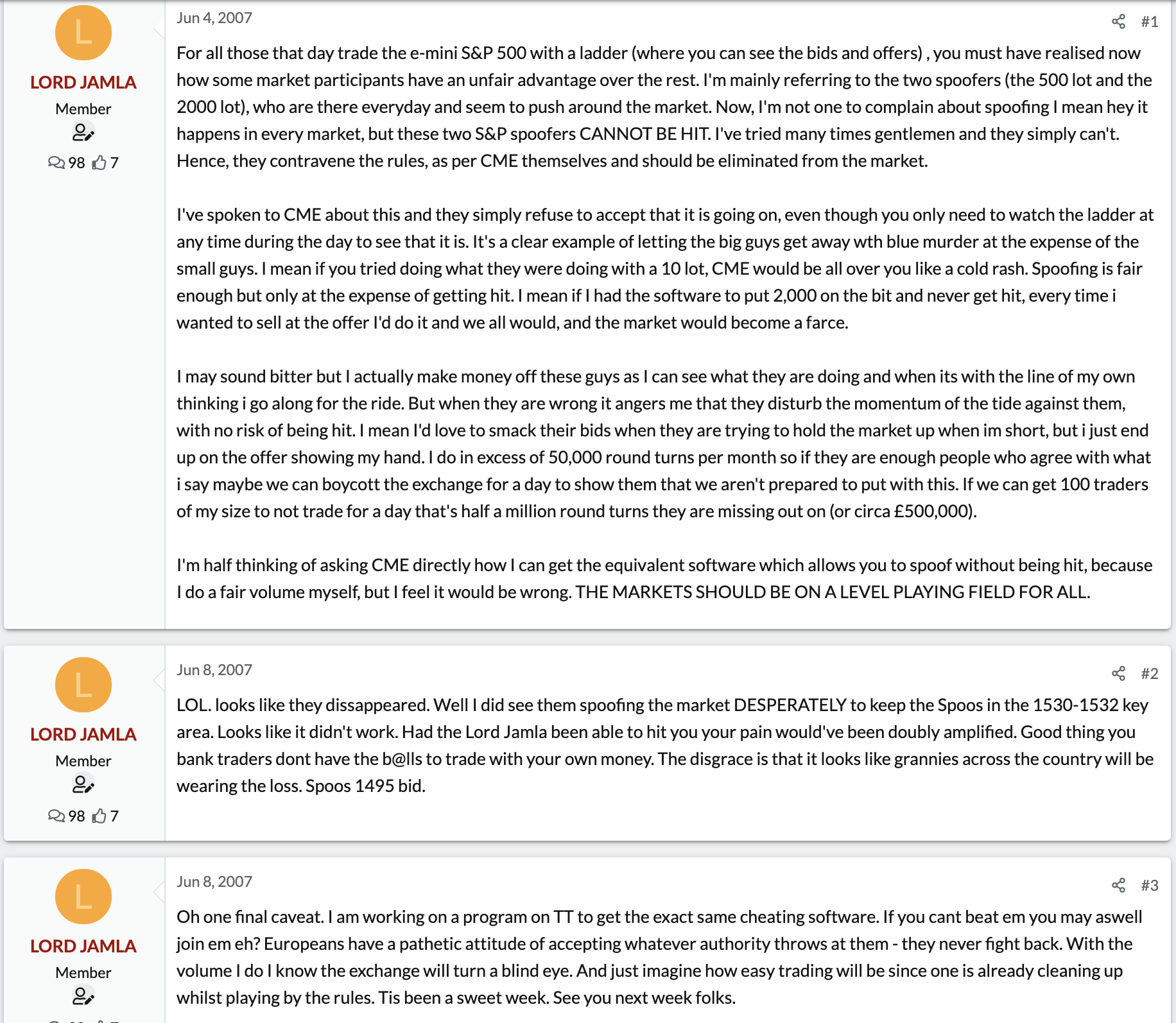

oh also i found his forum account and am in the process of archiving his contributions. tldr he was literally the Scooter of finance.

Comment

-

it absolutely didnt. the SEC didnt even charge him for it, i dont think its even mentioned in his arrest warrant or during the legal proceedings that followed.

in 2010 the market crashed. in 2012 an anonymous tip (imo an employee from CME, whom he was notoriously abusive to) dropped his name, and in 2015 he was arrested for 22 counts of fraud and market manipulation.

because the SEC essentially ended up busting him for spoofing orders during their investigation into the flash crash, and because there was a lot of suspicion that somehow spoofing had confused the poor defenseless algs, and because all this is actually kinda complicated, the media just branded him as the cause.

so for every 1000 news articles and youtube videos about 'nav sarao: the man who crashed the market' you have one like this:

https://www.reuters.com/article/us-f...-idUSKCN0V52OW

this btw is kinda the thesis of the video i want to make; he had fuckall to do with the market crash.

Comment

-

also ill get into more detail on the emini stuff but the long/short of it (ha ha ha) is that if you trade using the ladder, which almost everyone did in those days, you predicate your positions on what sorts of orders are stacked up in the asks/bids.

spoofing is the art of placing a huge amount of asks or bids and then when they are in danger of being filled by the price movement, you cancel them. in short they are bad-faith bids designed to instigate a small shift in market movement, placed without any intention of being filled.

around early 2008 nav started to go a little crazy because this was becoming absolutely rampant. between the HFT bots and the spoofing and a few other industrial scale exploits, it was getting MUCH harder for him to maintain his profits. so he called up a company that had made him custom trading software in the past and requested they build him software to automate spoofing. that piece of software essentially helped him earn about $68,000,000 by letting him do exactly what the hedge funds and commodities desks were doing.

and btw, Goldman Sachs just took a 1bn hit for doing this at their gold desk like a year ago:

https://www.ft.com/content/f2c918c2-...1-cc40379d4840

so its not like anyone stopped doing it. as mentioned, the reason why nav got busted and briefly went to jail and lost almost all his earnings is because .... hes not a bank.

GS made over a billion on spoofing gold futures alone iirc, so this is literally a wrist slap fine with 3 years of deferred prosecution. im guessing a GS employee ratted them out for a finders fee otherwise the SEC wouldnt have even bothered opening a case.

Comment

-

in 3 posts, he identifies the emerging presence of spoofing / phantom orders, calls out the people responsible, and declares to god and man that hes going to beat them at their own game.

WHICH HE DID, TO THE TUNE OF 68,000,000 UNITED STATES DOLLARINOS.

Comment

-

lol as i expected...they fucked the small guy while simultaneously turning a blind a to the real culprits, its just like they get paid to look away and find every excuse in the book to make someone into a scapegoat. Also nice PR work from the banks and other big player to spin this in a way they dont look bad and can shift blame

Comment

-

which i still dont understand how he could be so stupid to give it to all those shady people, evidently he is not some wacked autist who cant understand that people fucking each other over, like you said from his last post he clearly knows what shady is, but even then something doesnt computeOriginally posted by sonatine View Postin 3 posts, he identifies the emerging presence of spoofing / phantom orders, calls out the people responsible, and declares to god and man that hes going to beat them at their own game.

WHICH HE DID, TO THE TUNE OF 68,000,000 UNITED STATES DOLLARINOS.

Comment

-

i think the argument could be made that he was addicted to increasing his high score and without a fair market to do it in, he had to find alternatives. and the thing is, a lot of the scams he got caught up in.. they werent like, pie in the sky shit.Originally posted by Zalgo View Post

which i still dont understand how he could be so stupid to give it to all those shady people, evidently he is not some wacked autist who cant understand that people fucking each other over, like you said from his last post he clearly knows what shady is, but even then something doesnt compute

like he invested 10s of millions iirc in scottish wind farms. which, lets be honest, is a fairly prescient concept. and he had lawyers who were signing off on the DD. granted they were fairly sketchy lawyers who were raking points off his investments so it was in their interests to greenlight as many projects as possible but you get the idea, it was all very respectable to a kid who simply assumed that a legal team working out of a mahogany and oak office in a very tony neighborhood wouldnt simply ram his money into scams.

there was another guy who got another 8-digit-ish sum from him who was in the process of buying a swiss bank iirc. i believe nav was nowhere near the top investor in that project.

Comment

Comment