full disclosure i dont understand this subject as well as i need to and chances are you dont either:

X

-

-

some actual alpha:

Posty

Posty

, 18 tweets, 3 min read Bookmark Save as PDF My Authors

A thread//

At a very rudimentary level trading is all about locating areas where buyers or sellers were aggressive and then being prepared if/when price comes back to that level(s).

When either party is aggressive the DOM, especially on NQ, moves fast as hell.

“Smart money” knows that many retail traders eventually understand this basic, core principle of trading hence the infamous “stop hunt” There’s a reason failing traders are always crying that they lost money right before the move they were waiting for happens.

The folks who move the markets have access to much more than L2 data and know exactly where the liquidity is. While there are a handful of helpful indicators available to aid your trading they are not and have never been the reason markets move.

If you’re an RTH trader there is a short checklist of things I feel that should be completed PRIOR to the day’s trading session and a failure to do puts you at a disadvantage.

1. Levels that should be known and/or marked on your chart/DOM:

Prior OHLC

Weekly OHL

Prior Weekly OHLC

Prior day VAH/VAL

Current Weekly VAH/VAL

Prior day mid

Current week mid

Prior day VWAP

Current Weekly VWAP

The day’s OHL, mid, vwap

2. How was the overnight auction compared to the RTH close?

3. Remember that all 3 sessions play their part each trading day i.e Asia and London run autobid.exe to give NY a great price range to short. *These cycles happen DAILY*

4. Know before the opening bell if we are flat, gapping up/down.

Why?

Because a gap scenario should have you prepared for a potential different type of auction compared to a flat open.

If we are gapping up you want to be paying attention to seller aggression.

Why?

Because if sellers are unable to close the gap early on there is a potential for buyers to continue the bullish momentum and cause a trend day.

I highly recommend you track the opening range. The time is your choice. I love the 30s and 30m.

Why both?

30s was used by pit traders back then and many continue to still use it. I have found it is a wonderful tool to help identify what type of day it is i.e balance vs trend.

30m because that is very widely used.

This thread is probably all over the place, too much coffee lol, but I believe very helpful especially for newer traders. Two topics left. Probably most importantly is the psychology of trading. Markets thrive on trader psychology especially over reactions i.e FOMO.

I remember when I was a newbie well before I understood how the Global Index market really worked (everyone playing their part) and I would sit down at my desk right before the NY open and see that markets were super bullish compared to the prior day.

Being naive then I would always assume this meant we would continue that trend and you can imagine how that ended lol. MMs know retail traders think this way which is why so often you’ll see these moves that seem sporadic or “random” i.e rip at the open only to trend down.

Retail traders will put their stops in the EXACT place that smart money has their buy/sell orders which is often right above or below a key level like a prior open, high, low, close, etc.

Lastly…RISK MANAGEMENT. For me I like to look at trading risk management sort of like baseball. I’m the batter and the market is the pitcher. Only difference is there are no walks. The market will throw pitches to me alllllll day and I can choose what, if any, I want to swing at

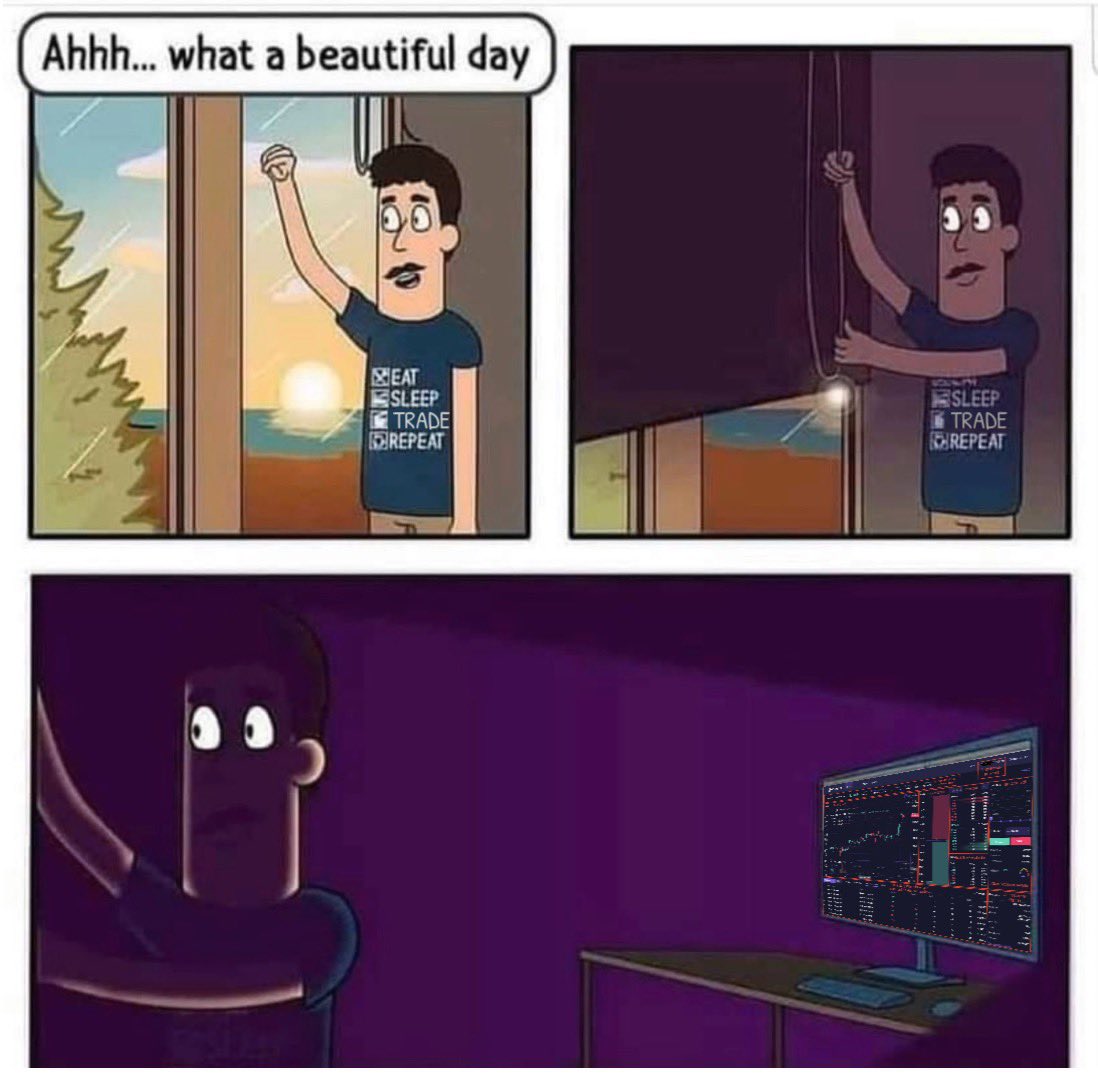

If I take three losing trades I strike out and walk away for the day. No more charts. Get up. Get outside. Exercise (I love to deadlift) Spend time with my girl. Something other than trading. Why? Because if I take three losing trades it’s clear that I’m not seeing things clearly

If you continue to trade after taking three Ls your mindset will be in the wrong place and you more often than not will dig yourself into a really bad position. Listen it’s okay to have a bad day. It’s going to happen.

What’s important though is that your winners far outweigh your losers from a monetary standpoint. You can have a 30% win rate and still be very successful if you let your winners run and cut your losers quickly.

This has been quite the run on thread but I hope it really helps others out there.

Comment

Comment