X

-

certainly not impossible but soups unlikely.Originally posted by gauchojake View PostI am about 50% cash right now. Might just dump the rest and hunker down. **market gains 3% on monday**

every other big sell-off, the reason we bounce out of it is because the fed was there with a bunch of market serotonin. this time the fed has no dry powder, we have jobs everywhere and job openings at an all time high, the economy is raging, real estate is soaring, etc etc. like yeah there are going to be a fucking ton of bull trap days but considering SPX is probably going to sheer off about 1000 fucking points by the time things stabilize, why snatch pennies from in front of a steam roller?

Comment

-

so we had a big leg down and now we're starting to see a bit more stability over night. tesla had a very bullish ER which, for better or worse, will lend the S&P a bit of stability / buoyancy.

my expectation is we see several days of fairly choppy behavior before the next significant period of growth/retreat.

i believe 4220-4200 is still a significant pivot range, albeit one on the low side of our current trend; market is at 4375 right now and dropping 175 points would be uhhh significant but we are up 100 points since london market opened last night and we have had days with multiple 100 point swings so im thinking less in terms of daily high / lows and more in terms of where we might find ourselves between now and early next week.

the scale/amplitude of these swings make it difficult to determine what constitutes a trend and what constitutes a leg and if i was looking to take positions that survive overnight id probably just sit on cash until we broke 4200 or 4450.

Comment

-

i got out of lcid december 13.Originally posted by onestep View PostUhhh hows that Lucid going for you?

it blew through my 12 month thesis in like 8 days and has been chopping around since. i have absolutely no interest in right now because the IV is trash; it can pack on 15% between now and march 4th call spread expiration and only pay out +270%.

honestly why bother when the S&P might shed another 800 points by then. if it was paying out 600% or better it would have my attention, im not going to bet against market trends at these odds tho.

also i have 2 actual concerns with lucid;

1) their cars are a little ugly.

2) im not into this 'buy now and maybe we can sort you out in 6 months' vibe.

and i get that supply chain issues are fucking everyone, but are people really going to buy a lucid if the mercedes EQXX is available? seriously its not _that_ much more expensive.

like i consider lucid a long term stock, i dont think its worth less than $45 a share. but there are easier dollars to make.

Comment

-

oh also fun fact lucid operates on the 'electrify america' charger network so i downloaded the app to just get a feel for access and i think the nearest one was like 60-90 minutes round trip from my house, excluding the charge time.

and even greasier there is no 'trip planner', which is literally something teslas been offering for what, 6 years?

they have a lot of work to do frankly.

Comment

-

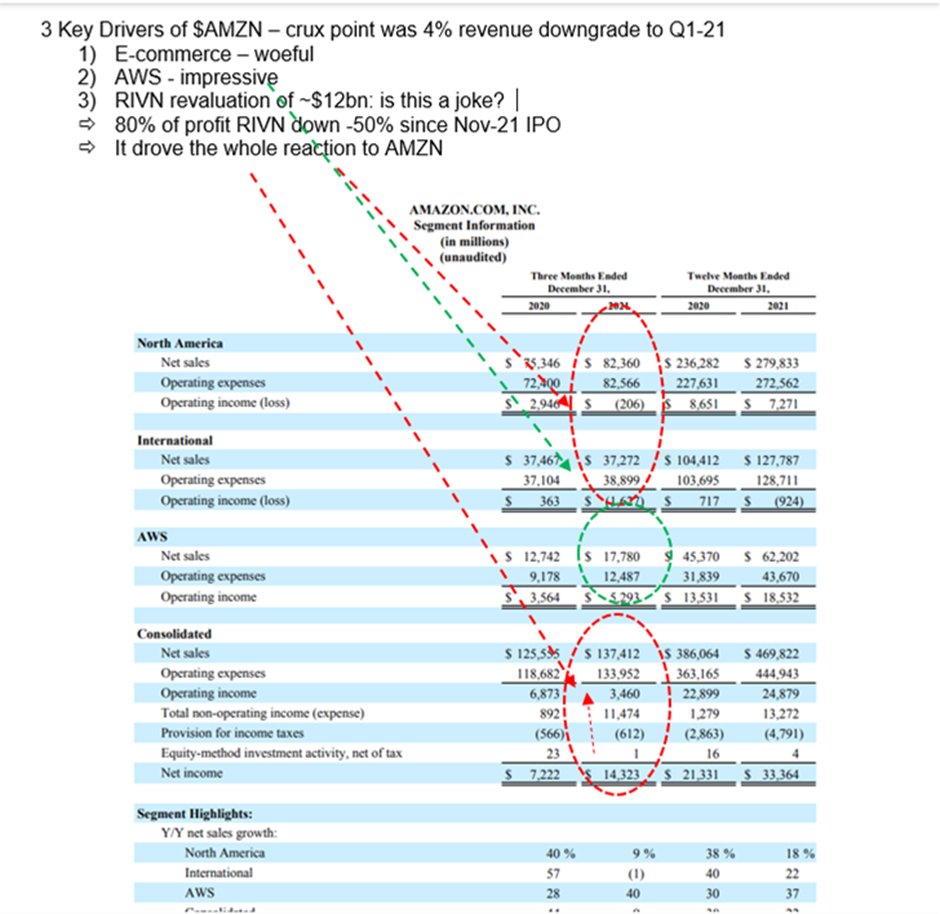

so amazon, yuge spike but its basically just fake book keeping based on an absurd valuation on rivian.

they literally didnt make their numbers and its profoundly unlikely those 3k calls are going to print.

Comment

-

I had heard the Rivian story too.

Was enough to start a squeeze.

-

im not sure id call it a squeeze. a squeeze would imply either shorts having to buy back shares when there arent enough shares to buy back and/or retail going batshit with options and again i dont think that happened or we would have seen it before market close when options were trading. i think it was just algs going ham because they hadnt been told that rivian valuation was a fairy tale tbh. obviously i could be wrong, after all it carried a lot of weight through the after market trading tonight, but seriously it should drop 10-12% by 8:00am. apologize in advance if im using a too narrow definition of the term squeeze.

-

Comment